The term share capital means the part of the capital that comes to the company from the issuance of shares. It refers to the portion of the company’s money which is raised in exchange for a share of ownership in the company. The law relating to it is enshrined under Section 43 of The Companies Act

Contents

- 1 Equity share capital

- 2 Types of Equity Share Capital

- 3 Preference share capital

- 4 The Differences

- 5 📊 Definition

- 6 💰 Rights and Returns

- 7 🔁 Convertibility & Redemption

- 8 🧮 Accounting & Capital Structure

- 9 ✅ Key Differences at a Glance

- 10 📌 Real-Life Example

- 11 🎯 Conclusion

- 12 Difference Between Equity Share Capital And Preference Share Capital

- 13 Unit 4: SHARE CAPITAL & DEBENTURE Syllabus

The definition provided in the statutes for equity share capital plainly states that they are those share capital which are not preference share capital. Keeping the lazy definition provided by our lawmakers aside, an equity share capital essentially means that capital of a company raised by offering shares. It is the money that company owners and investors direct towards a company’s capital and use it to develop or expand the operations of their venture.

It is also the money which is collected by the company by selling its shares at the price of face value.

Equity share can be divided into 2 categories-

- With voting rights or

- With differential rights as to dividend, voting or otherwise in accordance with such rules as prescribed.

Types of equity share capital include but is not limited to the following types:

- Issued Share Capital- This is the approved capital which is issued to the subscribers(investors)

- Authorised Share Capital- This amount is the highest amount an organisation can issue. This amount can be changed time as per the companies recommendation and with the help of few formalities..

- Paid Up Capital- amount actually paid by the shareholders on the respective shares

- Sweat Equity Share- This type of share is allocated only to the outstanding workers or executives of an organization for their excellent work on providing intellectual property rights to an organization.

- Right Share- These are those type of share that an organization issue to their existing stockholders. This type of share is issued by the company to preserve the proprietary rights of old investors.

- Subscribed Share Capital- This is a portion of the issued capital which an investor accepts and agrees upon

Preference share capital means that part of the share capital of a company which fulfils the following twin test:

- During the continuance of the company, it must be assured of a preferential dividend. The preferential dividend may consist of a fixed amount (say Rs 50,000 in one year) payable to preference shareholders before anything is paid to the ordinary shareholders, or the amount payable as preferential dividend may be calculated at a fixed rate, for example, 5 percent of the nominal value of each share.

- In the case of a winding up, whether or not there is a preferential right to the payment of any fixed premium or premium on any fixed scale, specified in the memorandum of association(MOA) or articles of association(AOA)

In simple words, shares which promise the preferred holder a fixed dividend, and whose payment takes priority over that of ordinary share dividends would meet the criteria for a preference share capital (of course after adhering to the rigid rules aforesaid mentioned).

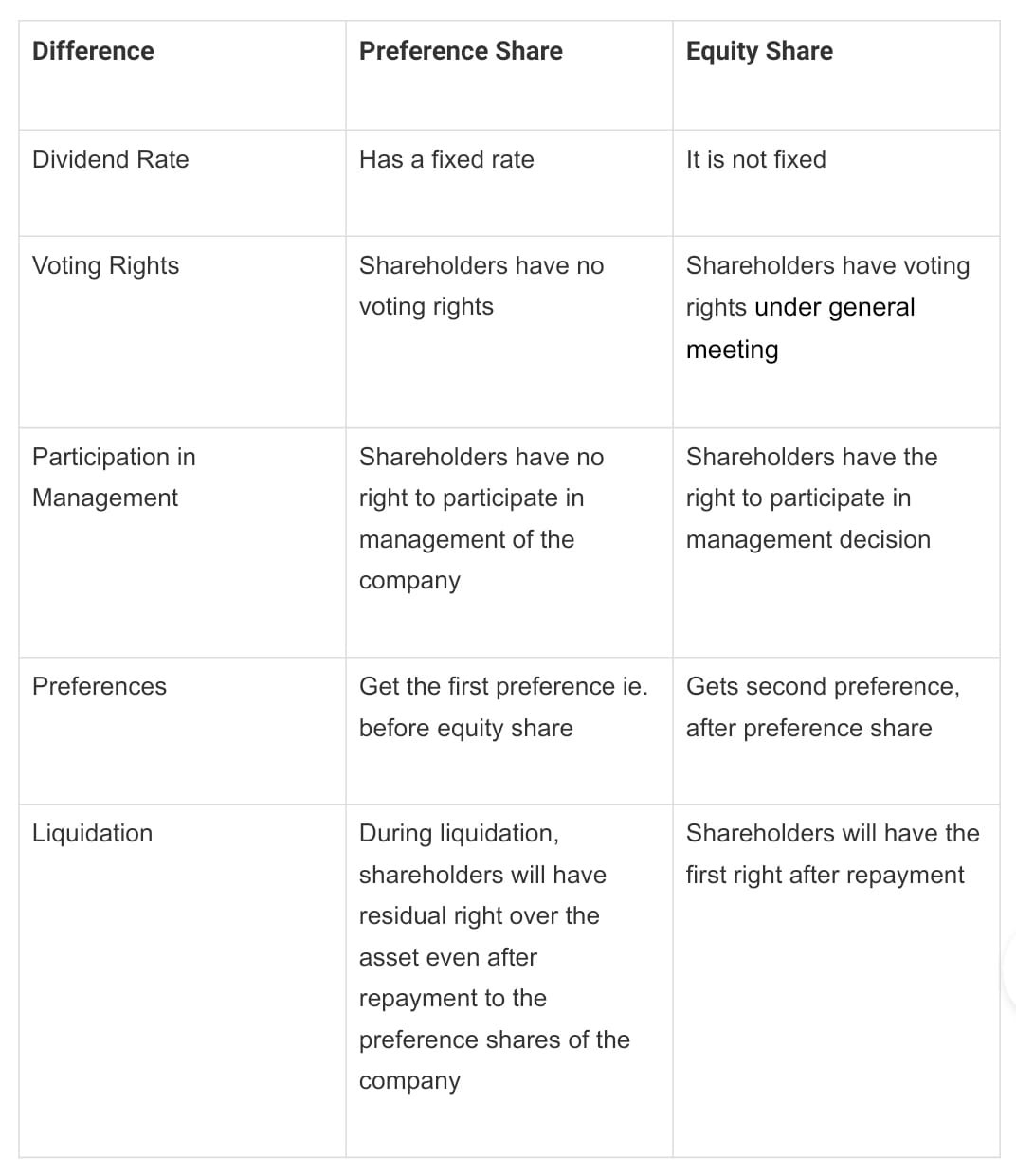

The Differences

Here’s a clear comparison of Equity Share Capital and Preference Share Capital — two key components of a company’s capital structure:

📊 Definition

| Category | Equity Share Capital | Preference Share Capital |

|---|---|---|

| Meaning | Funds raised by issuing equity shares to owners/shareholders | Funds raised by issuing preference shares with preferential rights |

| Ownership | Represents ownership in the company | Represents a hybrid of ownership and debt |

💰 Rights and Returns

| Category | Equity Shareholders | Preference Shareholders |

|---|---|---|

| Dividend | Not fixed; depends on profit | Fixed dividend (e.g., 8%, 10%) |

| Voting Rights | Yes – full voting rights in company matters | Limited/No voting rights (only in specific situations) |

| Priority in Dividend | Paid after preference shareholders | Paid before equity shareholders |

| Priority in Liquidation | Last to be paid (after debt & preference capital) | Paid before equity, after debt |

🔁 Convertibility & Redemption

| Category | Equity Share Capital | Preference Share Capital |

|---|---|---|

| Convertibility | Not convertible | May be convertible into equity shares |

| Redemption | Not redeemable | Can be redeemable within 20 years (Section 55) |

🧮 Accounting & Capital Structure

| Category | Equity Share Capital | Preference Share Capital |

|---|---|---|

| Risk & Return | Higher risk, higher return | Lower risk, fixed return |

| Residual Claim | Yes – claim over profits & assets | Limited – fixed return, no share in surplus |

| Dilution of Control | Affects control significantly | Does not affect control much |

✅ Key Differences at a Glance

| Basis | Equity Shares | Preference Shares |

|---|---|---|

| Dividend | Variable | Fixed |

| Voting Rights | Yes | Usually No |

| Priority | Last in line | Priority over equity |

| Convertibility | Non-convertible | Can be convertible or non-convertible |

| Risk | High | Moderate |

| Return | Based on profits | Fixed percentage |

📌 Real-Life Example

Let’s say:

- A company issues 1,000 equity shares and 500 preference shares.

- In a profit-making year, preference shareholders get ₹10 per share (fixed).

- Equity shareholders get what remains — could be ₹20, ₹5, or even nothing (if no profit).

🎯 Conclusion

| Equity Shareholders | Preference Shareholders |

|---|---|

| Owners of the company | Preferential stakeholders |

| Control & decision-making | Financial return-focused |

✅ Companies use equity for ownership capital and preference for flexible financing.

Would you like:

- A comparison chart image for easy reference?

- A PowerPoint-ready slide?

- A case study showing both types in a real company?

Let me know!