Paid-up Share Capital, also known as paid-in capital or contributed capital is the amount received from the shareholders by the company in exchange for shares of stock.

The members of the Company at any time may Increase or Decrease the Share Capital of the Company. The mode of Increasing the Share Capital of the Company can be either through issuing the shares to the existing shareholders of the company or either to the other persons whether it is a Public Limited Company or Private Limited Company. But the Private Limited Company carries the restriction to issue shares to the General Public as the Private Limited Company cannot issue shares to more than 200 People.

Contents

- 0.1 Share Capital

- 0.2 Authorised Share Capital

- 0.3 Paid-up Share Capital

- 0.4 Issued Share Capital

- 0.5 Called up Capital

- 0.6 Procedure to Increase the Paid-up Share Capital

- 0.7 Procedure to Increase the Authorised Share Capital

- 0.8 🧾 1. DIFFERENCE: Authorised vs. Paid-up Share Capital

- 0.9 🔁 PROCEDURE TO INCREASE AUTHORISED SHARE CAPITAL

- 0.10 ✅ Step 1: Check AOA (Articles of Association)

- 0.11 ✅ Step 2: Hold Board Meeting

- 0.12 ✅ Step 3: Hold EGM (Extraordinary General Meeting)

- 0.13 ✅ Step 4: File ROC Forms

- 0.14 💰 PROCEDURE TO INCREASE PAID-UP SHARE CAPITAL

- 0.15 ✅ Option 1: Rights Issue – Section 62(1)(a)

- 0.16 ✅ Option 2: Private Placement – Section 42

- 0.17 ✅ Option 3: Bonus Shares – Section 63

- 0.18 ✅ Option 4: ESOP/ Sweat Equity / Convertible Instruments

- 0.19 📄 ROC FORMS SUMMARY

- 1 💡 Example Scenario

- 2 ⚠️ Important Notes

- 3 📌 Summary

The Share Capital is the amount of the company that the owner of the company has invested to start the business of the Company by issuing shares to the people called as Shareholders. The Shareholders of the company are the owners of the company. Shares are classified into two types: Equity Shares and Preference Shares. These types of Shares carry differential rights and Preferential rights respectively that are according to the nature of shares.

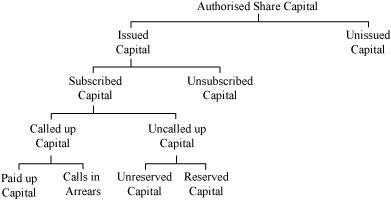

The Share Capital has been determined on Different Terms:-

- Authorised Share Capital

- Paid-up Share capital

- Issued Share Capital

- Called up Capital

- Subscribed Share Capital

Authorised Share Capital is the share capital that the company can raise the maximum limit amount which is issued as shares to its Shareholders. This Amount has been referred to in the Capital Clause of the Company MOA (Memorandum of Association). It can also be altered with the consent and approval of the shareholders.

Paid-up Share Capital, also known as paid-in capital or contributed capital is the amount received from the shareholders by the company in exchange for shares of stock. The shareholders receive shares in the company Share Capital payments and it cannot be more than the Authorised Share Capital of the Company.

Issued Capital is a type of Share capital and a portion of the authorised share capital of which the company allocates a portion from time to time in order to issue shares to shareholders. It is issued by the company at the initial stage that is while the incorporation of the company and with respected time by way of allotment of shares for a subscription.

Called up Capital

The Called up capital of the company is the amount which has been called up by the company while issuing the shares to the shareholders. The Company may issue the Called up capital while issuing that can be either partly or fully.

Subscribed Capital

The total amount of shares that the investors have promised to buy is called as Subscribed Capital. The Subscribed Capital should either equal or less than the issued capital of the company.

- It is required to conduct a Board Meeting of the company and pass the board resolution for issuing the Paid-up Share Capital to either existing shareholders or other than existing members.

- It is required to provide Notice as per Section 101 of Companies Act,2013 to the members of the company to hold the General Meeting and pass a resolution to issue the Paid-up Share Capital.

- Submit the relevant Form to MCA (Ministry of Corporate Affairs) and Submit to ROC ( Registrar of the company) as well of the relevant resolution passed for increasing Paid-up Share Capital.

- Within the period of 60 days issue and allot the shares to the Shareholders of the company and depositing of such amount as prescribed.

- After Allotment of Shares issue the Share Certificate to the shareholders within 2 months after allotment.

Paid-up Share Capital should be not more than the Authorised Share Capital as it is included in the capital clause in the MOA (Memorandum of Association).

- The AOA ( Articles of Association) of the company must be authorised to increase the Amount of Authorised Share Capital, If not it is required to alter its Articles while passing the Special resolution in the General Meeting.

- It is required to conduct a Board Meeting of the company and pass the board resolution for Increasing the Authorised Share Capital through the Director authorised to do so or any other person assigned to call them through notice and submit such relevant documents to the Registrar.

- It is required to provide Notice as per Section 101 of Companies Act,2013 to the shareholders of the company to hold the General Meeting and pass resolution to increase the Authorised Share Capital.

- It is required to file FORM MGT 14 within 30 days by the date of passing the special resolution to the registrar.

- It is required to Submit FORM SH-7 with an altered copy of MOA (Memorandum of Association) and the result of Special resolution with explanatory notes to the registrar at which such jurisdiction of the registered office of the company is situated.

Increasing the Paid-up Capital and Authorised Share Capital of a company in India requires following the legal process under the Companies Act, 2025, and filing necessary forms with the Registrar of Companies (ROC).

Here’s a step-by-step guide for both:

| Term | Meaning |

|---|---|

| Authorised Capital | Max share capital a company is allowed to issue (mentioned in MOA) |

| Paid-up Capital | Actual amount of capital paid by shareholders for issued shares |

✅ Paid-up capital can never exceed authorised capital.

➡️ So, to increase paid-up capital, increase authorised capital first (if needed).

🔁 PROCEDURE TO INCREASE AUTHORISED SHARE CAPITAL

✅ Step 1: Check AOA (Articles of Association)

- Ensure AOA allows for an increase in authorised capital

- If not, amend AOA first via a special resolution (file MGT-14)

✅ Step 2: Hold Board Meeting

- Approve the proposal to increase authorised share capital

- Approve notice for Extraordinary General Meeting (EGM)

✅ Step 3: Hold EGM (Extraordinary General Meeting)

- Pass an Ordinary Resolution under Section 61(1)(a) of the Companies Act, 2013

- Members must approve the increase

✅ Step 4: File ROC Forms

- Form SH-7: Filed within 30 days of passing the resolution

- Attachments:

- Board resolution

- Shareholder resolution

- Altered MOA (reflecting new capital)

- Explanatory statement

- Attachments:

💰 PROCEDURE TO INCREASE PAID-UP SHARE CAPITAL

Once you’ve increased authorised capital (if needed), you can increase paid-up capital through:

✅ Option 1: Rights Issue – Section 62(1)(a)

- Offer new shares to existing shareholders in proportion to current holdings

- Issue a letter of offer with terms

ROC Filing:

- Form PAS-3 (Return of allotment) within 15 days of allotment

✅ Option 2: Private Placement – Section 42

- Offer shares to selected investors (not exceeding 200 per financial year per security type)

- Requires special resolution

ROC Filing:

- File PAS-4 (Private placement offer letter)

- PAS-3 for allotment within 15 days

- Issue shares to existing members from free reserves or securities premium

- Requires board and shareholder approval

✅ Option 4: ESOP/ Sweat Equity / Convertible Instruments

- For employees/directors or against conversion of CCDs/CCPS

- Follow special procedures under the Act

📄 ROC FORMS SUMMARY

| Form | Purpose | Time Limit |

|---|---|---|

| MGT-14 | Special resolution (if AOA amended) | 30 days |

| SH-7 | Increase in authorised share capital | 30 days |

| PAS-3 | Allotment of shares (increase in paid-up capital) | 15 days |

💡 Example Scenario

A company has:

- Authorised Capital: ₹10 lakhs

- Paid-up Capital: ₹8 lakhs

Wants to increase paid-up capital to ₹15 lakhs → must first increase authorised capital to at least ₹15 lakhs by following SH-7 process, then allot new shares through PAS-3.

⚠️ Important Notes

- File all pending annual filings before making capital changes

- Allotment money must be received via banking channels

- Maintain proper board/shareholder meeting minutes

- Non-filing leads to penalty of ₹1,000/day (subject to max limit)

📌 Summary

| Step | Authorised Capital | Paid-up Capital |

|---|---|---|

| 1 | Check AOA & pass resolutions | Pass board/shareholder resolution |

| 2 | File SH-7 + MGT-14 (if needed) | File PAS-3 after allotment |

| 3 | Update MOA | Issue share certificates |

Would you like:

- Board resolution templates for capital increase?

- ROC form filing help (SH-7, PAS-3)?

- Checklist PDF for compliance?

Let me know—I’ll tailor it for your case!